Quality, not quantity

We have made quality our habit. It’s not something that we just strive for – we live by this principle every day.

Our services

Corporate Tax

Direct Tax

With the introduction of the Federal Corporate Tax in the UAE, businesses face new regulatory challenges. At Profound, we provide end-to-end Corporate Tax services, including tax compliance, taxable income calculations, exemptions, and reporting, ensuring adherence to UAE tax laws. We assist businesses in navigating complex tax structures while minimizing liabilities and avoiding penalties.

VALUE ADDED TAX

We assist companies in VAT Registration, Tourist Refund Scheme setup, as well as periodic Return filing with the UAE FTA.

Our experts will conduct an impact analysis of the types of transactions you enter to identify appropriate offsets and least cash flow impact to your firm.

Our services range from simple consultations to consultations on a retainer basis to appropriately prepare for compliance with FTA requirements.

Transfer Pricing

In today’s globalized economy, Transfer Pricing compliance has become essential. Profound offers comprehensive Transfer Pricing services in alignment with UAE Corporate Tax regulations and OECD standards. From preparing Master File and Local File documentation to ensuring transactions meet the arm’s length principle, we help businesses mitigate risks and maintain transparency in intercompany dealings.

At Profound, we pride ourselves on delivering reliable and efficient tax consulting and compliance services tailored to the specific needs of each client. By focusing on CT, VAT, TP, and compliance, we enable businesses to thrive in a constantly evolving regulatory environment

Tax Agent Services

As a registered Tax Agent with the Federal Tax Authority, Profound acts as a trusted intermediary between businesses and the FTA. Our Tax Agent services ensure full compliance with UAE tax laws and provide strategic support to simplify tax processes

Filing Tax returns

Filing VAT and Corporate Tax returns on behalf of clients

Representing

Representing businesses during FTA audits and inquiries

Real Estate Valuation

In an evolving market, accurate real estate valuation is essential for financial reporting, tax planning, and investment decisions. At Profound, we provide comprehensive real estate valuation services, ensuring fair and reliable assessments of tangible assets such as land and buildings. Our valuations comply with international standards and local regulatory requirements, supporting businesses with precise asset appraisals for auditing, taxation, and financial structuring. Whether for corporate financial statements, acquisitions, or investment strategies, Profound delivers expert valuation insights to enhance decision-making and compliance.

UAE FTA – 2026 Mandate

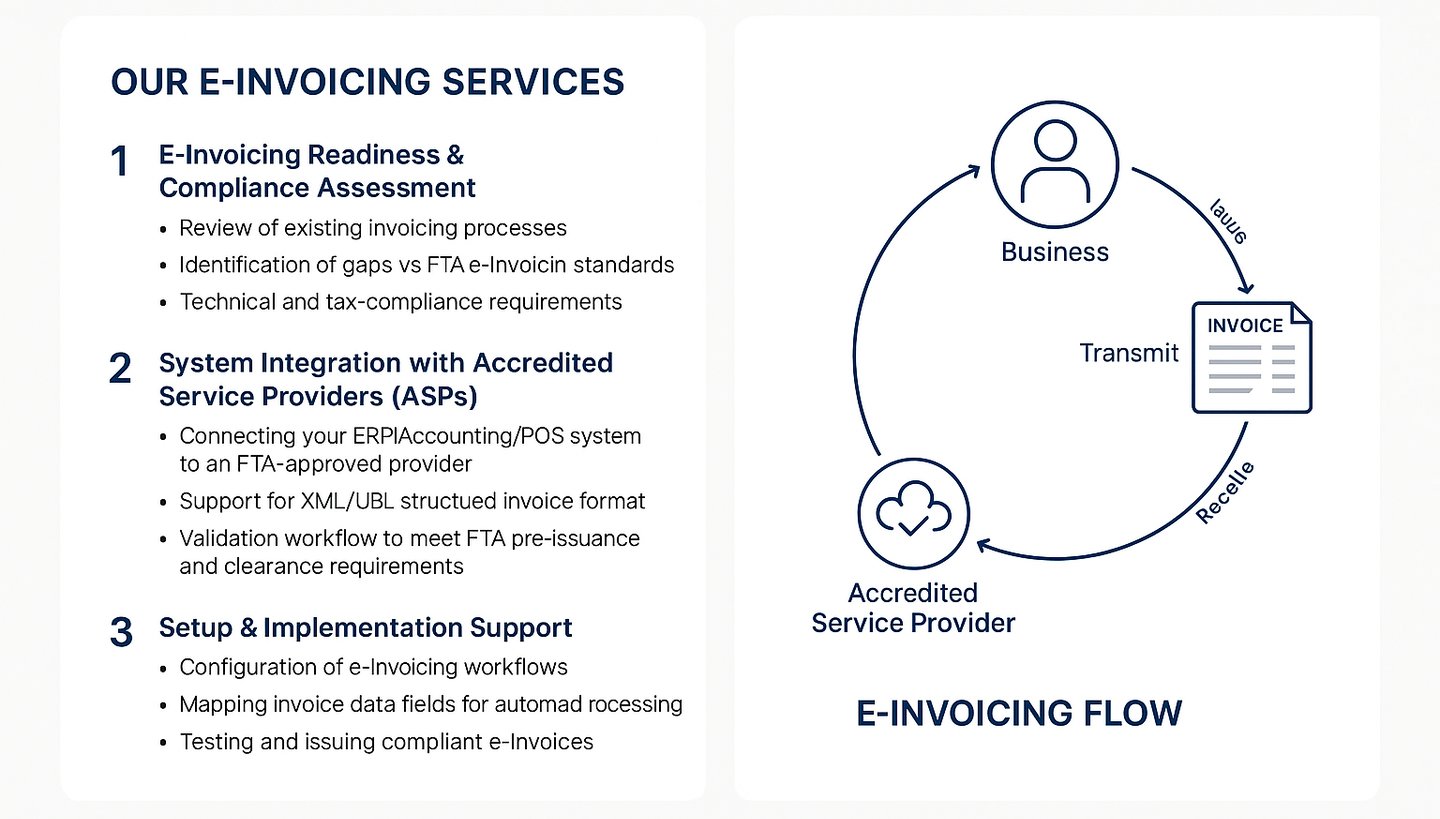

At Profound, we now provide end-to-end UAE e-Invoicing compliance services to help businesses meet the Federal Tax Authority’s new digital invoicing requirements effective from 1 July 2026.

We support companies in preparing, implementing, and integrating e-Invoicing in line with the UAE Digital Tax Invoice Framework, ensuring full compliance with Phase 1 (Generation) and Phase 2 (Clearance)